They are Hawaii, April 20 Iowa, June 1 Maryland, July 15 and Oklahoma June 15, although technically that only applies to tax payments, whereas returns still had to be filed by April 15. They include Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Vermont, Virginia, West Virginia and Wisconsin. Tax penalties: Here's what to do if you can't pay your taxes this yearĪnd most have extended their filing deadlines to May 17 to align with the federal schedule. The IRS extended the federal tax deadline for residents in those states to June 15.ĭo I also get more time to file my state taxes then?Įven though the IRS extended the federal filing deadline, it was up to individual states to set their own tax deadlines. The second applies to anyone living in Texas, Oklahoma and Louisiana, who were hit hard by the February storms. Your usual April 15 payment was still due on April 15. The first applies to anyone who pays estimated taxes, including many small businesses.

There are two exceptions to the new extended federal deadline. That way, you will avoid being hit with any potential late filing or late payment penalties.īut if you do miss your filing or payment deadlines, you may be eligible for first-time penalty relief. Unless you choose to file for an extension (see question below) you must file and pay any remaining federal income taxes you owe for 2020 by May 17.

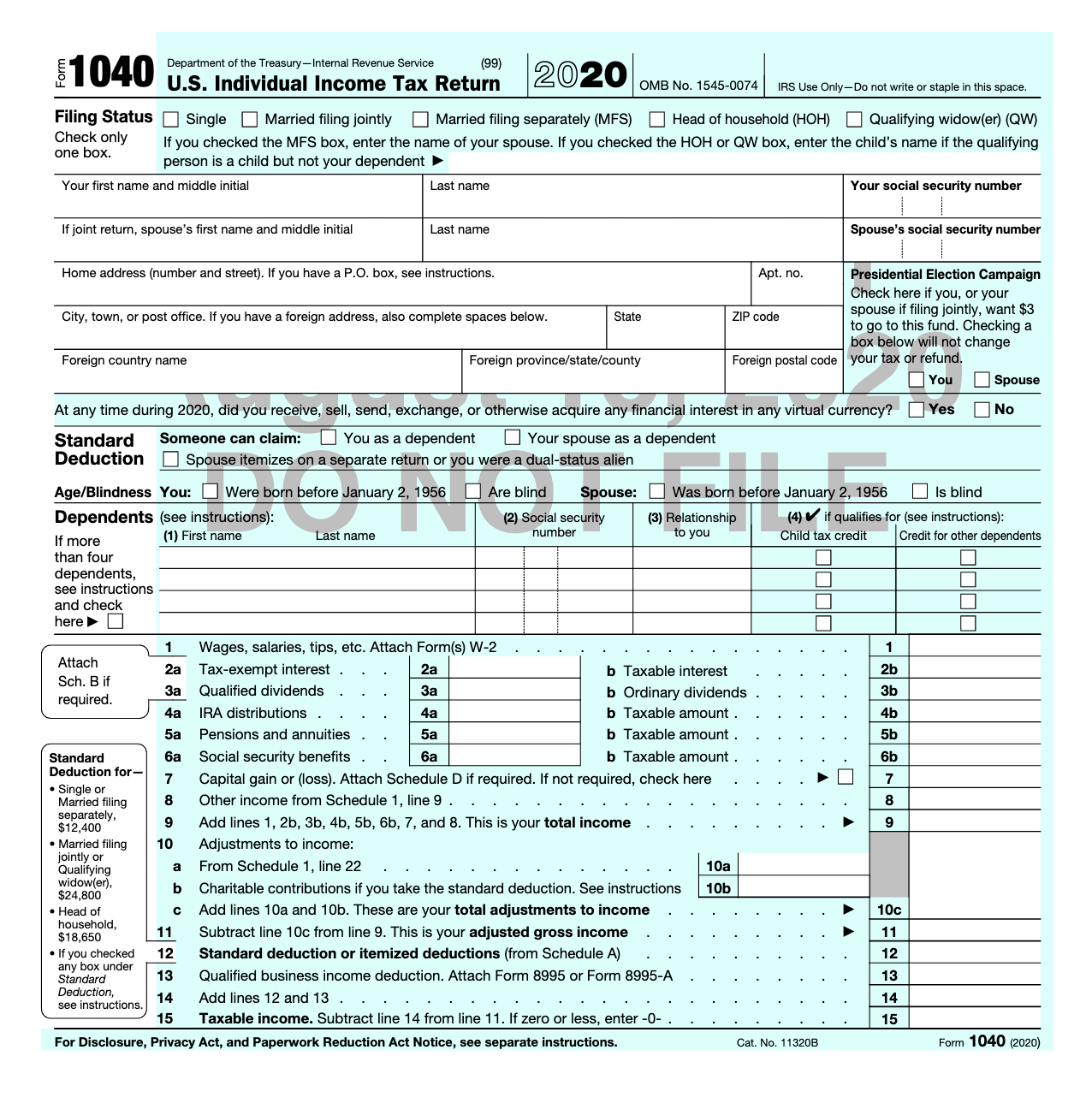

Due to the Covid crisis, there are plenty of new and revised provisions and important dates you will need to know about before filing your return this year. Many of the upheavals over the past year have caused other changes to your taxes. But the filing deadline’s not the only thing that’s changed. It’s a month later than usual, thanks to the pandemic. Next Monday, May 17, is the official deadline for individuals to file their 2020 federal tax return, and in most instances their state tax return, too.

0 kommentar(er)

0 kommentar(er)